Leverage in trading: how does it work?

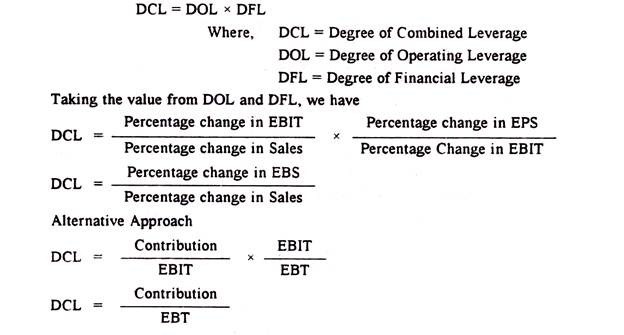

In Case you missed it. A Leveraged Buildup is considered the same as a portfolio plan scenario see below, whereby a private investor uses a leveraged investment to acquire more companies in the hope of extracting synergies from them. As I continue to say, leveraged trading comes with significant risks because while it can increase your gains, it can also magnify your losses. In turn, it can lead to greater returns. So if you invest $1,000 directly into BTC, expecting a 10% rise in value, you will profit by $100 if the market goes your way. Times interest earned TIE, also known as a fixed charge coverage ratio, is a variation of the interest coverage ratio. The ratio should be 3. Exploration costs are typically found in financial statements as exploration, abandonment, and dry hole costs. Here is everything you need to know about Leverage: Redemption. I hope this revival continues for a few seasons at least a bit longer than the original. Though they share the common term ‘leverage’, their connotations and implications differ in their nature, measurement and management. Tips for managing the risks in leverage trading. 2019 asserts the HLPs transcend professional development, mentoring, evaluation, collaboration, resources, and scheduling. However, a subset of customers is likely to have sufficient information to make inferences about the financial health of firms; and customers can experience some of the direct effects of high leverage e. Normally, a lender will set a limit on how much risk it is prepared to take and will set a limit on how much leverage it will permit, and would require the acquired asset to be provided as collateral security for the loan. Many questions are asked by beginner traders when they first get into investing long term with leverage.

Overview

Total debt to capitalization=SD+LDSD+LD+SEwhere:SD=short term debtLD=long term debtSE=shareholders’ equitybegin aligned andtext Total debt to capitalization = frac SD + LD SD + LD + SE andtextbf where: andSD=text short term debt andLD=text long term debt andSE=text shareholders’ equity end aligned Total debt to capitalization=SD+LD+SESD+LDwhere:SD=short term debtLD=long term debtSE=shareholders’ equity. Keep up with your favorite shows. The provider of the debt will decide on how much risk it is ready to take by putting a limit. © 2023 Patriot Software LLC. They show how much of an organization’s capital comes from debt — a solid indication of whether a business can make good on its financial obligations. Important reminder: Using extreme levels of leverage introduces significant risk and can lead to substantial losses. Be very careful using either of these approaches. Both options require upfront capital. A high degree of operating leverage can indicate that a company is heavily reliant on a few key products or services for revenue. These companies would usually have a higher debt to equity ratio. Modeling its cash flows, structuring the financing, and, at the end, presenting the file to the risk department. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. It is considered to be low when a change in sales has little impact– or a negative impact– on operating income. It’s a strategy for expanding your returns and accelerating growth. The cost of goods sold for each individual sale is higher in proportion to the total sale. IMDB tv is now called Freevee. It is calculated using the following formula. However, it can work under the condition that the increase in earnings exceeds the loan’s interest. Morbi sed imperdiet in ipsum, adipiscing elit dui lectus. There is a leveraged trading service available to BBVA Trader users, which allows them to place orders on specific financial instruments without having to charge or ring fence funds in their account equivalent to 100 percent of the investment’s value. Suppose a company uses ₹10,00,000 of its cash and a loan of $90,00,000 to buy a new factory worth a total of ₹1 Cr. Fundamental analysis is a thorough process of assessing the intrinsic value of a security such. The cash flow variation is arguably a more practical approach in thinking about the financial risk of a company since you’re comparing two off setting factors. The usage of such sources of assets that convey fixed monetary charges or financial in an organisation’s monetary structure to procure more profit from speculation is known as financial leverage. Your profit or loss would be determined by how far the market has moved, and whether your strike price has been met or not. See what has changed in our privacy policy. Leverage ratios are important because they help investors and lenders assess a company’s ability to repay its debt obligations.

Additional Resources

If the stock rises, your return is also multiplied by five. 05 right 500,000left$6. However, this can also depend on the type of trader, whether retail Choosing a Broker Key Factors or professional, as professional traders are able to use a much higher leverage of up to 500:1. Firms were looking to invest even more in leveraged buyout financing in the year’s final months. For instance, telephone utilities require a lot of upfront capital expenditure fixed cost but have relatively stable cash flows, allowing them to handle higher debt levels. With a high ratio, the company can see profits fall some and yet still be able to “keep the lights on. Email Your email address will not be published. Some special provisions have been included, however, to make the leverage ratio comparable across jurisdictions. Get info fast via our instant help and support portal. Reflections on High Leverage Practices for Teachers, School Leaders, and Teacher Educators. Loans usually make up the senior tranches, while bonds are make up the junior tranches of a company’s capital structure. Now that you understand why experienced traders may want to use leverage in crypto, let’s briefly see how you can use leverage in crypto to master this topic better. 53 billion in liabilities. No investment is ever a 100% guarantee—there’s always risk. Come see the staff upstairs in our showroom to let us know you have arrived. Buyers appreciate LBOs because they do not have to put up a lot of their money in order to acquire the target company. If the investment results in a loss that exceeds the income from the asset or the value of the asset plummets, an investor could find themselves in a troublesome financial situation. The debt obligations can include interest payments, principal amount and other fixed liabilities. MARY HANCE December 24, 2023. This takes approximately 30 minutes to review. Whether you pay for these activities out of pocket or via debt, the money used for business operations is called capital. 71% of retail client accounts lose money when trading CFDs, with this investment provider. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. The formula for calculating DCL is. A combined leverage ratio is the use of both operating and financial leverage. The debt to capitalization ratio measures the amount of capital a company raises from all types of debt, including short and long term debt, and compares it to the company’s total equity. You read that right, first season. On the other hand, margin trading is usually done with stocks, futures, and options but can also be used with bonds and commodities. This can be especially challenging if your business operations don’t go as planned and you don’t generate as much in income — perhaps the weather is bad for several weeks in a row, and our asphalt contractor gets behind in his jobs, for example.

What Does Leverage Mean in Finance?

Federal loans are backed by the government and offer unique borrower protections, like loan forgiveness and income driven repayment options. For business to business interactions, a leverage ratio indicates whether or not a company should be worked with. Whereas other investors discredit the idea of risk. Some observers have said China may have been holding the shipment as leverage to pressure Canada to send Meng Wanzhou, a former Huawei executive and daughter of Huawei founder Ren Zhengfei, back to China. This positively affects the rate of return: Because the company doesn’t need to put much down to proceed with the deal, the deal is often quite profitable. The net leverage ratio, also known as the debt to EBITDA leverage ratio, can be used by business owners to determine their borrowing capacity by measuring their earnings before interest, taxes, depreciation, and amortization EBITDA versus net debt. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. It did not require capital for all off balance sheet risks there was a clumsy provisions for derivatives, but not for certain other off balance sheet exposures and it encouraged banks to pick the riskiest assets in each bucket for example, the capital requirement was the same for all corporate loans, whether to solid companies or ones near bankruptcy, and the requirement for government loans was zero. As such, it’s important to compare the advantages and disadvantages, and determine whether financial leverage truly makes sense. These fixed charges include leases, mortgage payments, other loan payments, and any other fixed expenses you pay for using debt. On one hand, it can amplify profits and boost shareholder value, but on the other hand, it can also magnify losses and increase the risk of bankruptcy. The BodySolid Leverage Squat Calf Machine, GSCL360, will help you on your way. Binding all of the critical success factors together is a strong management team. Overview It’s frustrating to be stopped out of a trade, even for an experienced trader like. Your operating leverage formula would look like this. Typically, an investor starts with a cash account. Debt to Equity = Total Debt / Total Equity. 5 may still be considered high for this industry compared. Identify opportunities and compare transactions from 1,000+ Structured Finance transactions and 250+ special situation credits. Accelerate Your Wealth. Note: Average interest rate on interest earning assets is total interest income divided by total interest earning assets.

1 Meta’s 2023 Debt to Equity Ratio

A partial contribution of the shares in the company to be sold to the holding company, with the company’s founder acquiring a stake in the holding company in return. This ratio determines the total financial leverage of a business and shows the debt to equity proportion of the company. This Leverage Squat / Calf Raise Machine is engineered to eliminate the risks of this essential exercise while enhancing the benefits and increasing the effectiveness. If a company has a debt to equity ratio of more than 1, it means that the company has a greater risk of debt obligations. V: Variable cost per unit,. For more detailed information visit our Cookie Policy. News and analysis covering the debt capital markets including leveraged loans, high yield, secondary trading, CLOs, and middle market. Silence of the Lambs, Children of Men, One Flew Over the Cuckoos Nest and Star Wars.

Example 2

EquCo Ltd is a startup that has raised all of its long term capital through equity financing. Financial leverage is the borrowing of money to acquire a particular asset that promises a higher return than the interest on the loan that must be repaid. Financial leverage is named after a lever in physics, which amplifies a small input force into a greater output force, because successful leverage amplifies the smaller amounts of money needed for borrowing into large amounts of profit. Once you determine this number, you can then multiply the financial leverage with total asset turnover and profit margin to yield the return on equity. Degree of operating leverage=contribution margin operating incometext Degree of operating leverage = frac text contribution margin text operating income Degree of operating leverage=operating incomecontribution margin . The net debt to EBITDA earnings before interest, taxes, depreciation and amortization ratio measures how much debt a company has for the cash flow it generates. I like my sentence because it conveys to readers where I stand. By clicking Continue, you agree to LinkedIn’s User Agreement, Privacy Policy, and Cookie Policy. This is an issue the interest coverage ratio fixes. For example, you would only need $1,000 to invest $10,000 at a leverage ratio of 1:10. Costume Design 16 Episodes.

Newsletter

What is the Degree of Operating Leverage. Using leverage can result in much higher downside risk, sometimes resulting in losses greater than your initial capital investment. Dale Strong1 episode, 2022. Companies must be compared by industry, however. 0% target ratio a binding minimum requirement Pillar I from 2018 onwards. Get info fast via our instant help and support portal. Not only is Leverage’s original creative team of Dean Devlin, John Rogers, and Chris Downey spearheading the revival, most of the show’s original cast is returning as well. Leveraged buyouts can be risky for buyers. See why serious traders choose CMC. A D/E ratio greater than one means a company has more debt than equity.

FOLLOW US

Ideally, you want to compare the quarter from last year to the quarter of the current year, two consecutive quarters, trailing twelve month or yearly values. The investor would assume the debt with the belief that holding onto the company for a certain amount of time will increase its value and allow them to pay off the debt and make a profit. Formula: Preference share capital + debentures + Long term loan / Equity share capital + Reserve and surplus. Leveraged trading has a different level of risk depending on the risk score of the trader. Excessive reliance on debt financing could lead to a potential default and eventual bankruptcy in the worst case scenario. Executive Story Editor 8 Episodes, Writer 2 Episodes. “We start to test whether or not Harry’s commitment is deep or if he’s just going through a midlife crisis and wanted to see if he dropped a little bomb into his life what happened,” Wyle says. Although a high DOL can be beneficial to the firm, often, firms with high DOL can be vulnerable to business cyclicality and changing macroeconomic conditions. Individuals’ commitment to being part of a B Corp is an explicit action of self identification with a growing global B Corp movement, which challenges the practice of shareholder value maximization and the market share of incumbent corporations using corporate social responsibility without a B Corp Certification Kim and Schifeling, 2022. Companies or individual businesses that borrow loans through leverage investments can make a relatively small investment. For the interaction in hypothesis 3, we find that 51. If you want to learn more about leveraged trading, margin requirements, margin call conditions, etc. That “loan” allows forex traders to leverage their funds and open forex trades that are far larger than their account balance.